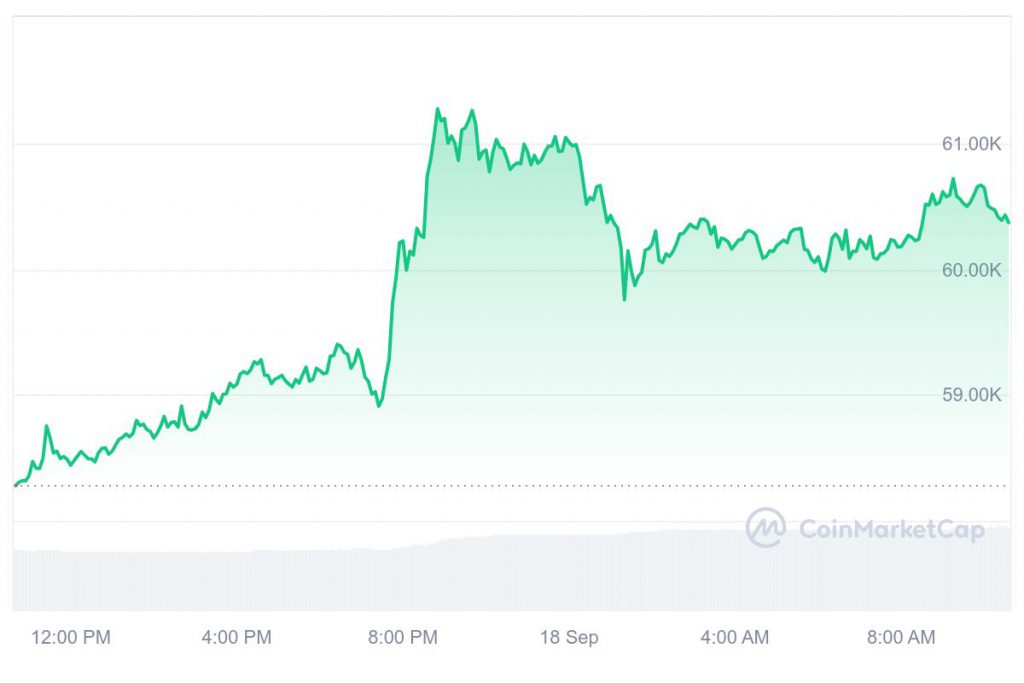

The cryptocurrency market has been on a roller coaster ride lately. Bitcoin (BTC) has struggled to maintain its position over the $60,000 mark. The last seven days, however, have played out positively for the king coin as it surged by over 7% and managed to rise to a high value of $61,000. BTC traded at $60,372 at press time, with a nearly 4% surge over the last 24 hours.

Also Read: Ethereum’s Buterin L2 Standard Says Most Network’s are Stage 0

Bitcoin’s Recent Performance And Future Predictions

Despite its latest surge, Bitcoin traded 18% below its all-time high. The world’s largest cryptocurrency hit a peak of $73,750 about six months ago in March 2024. BTC has made some increased efforts to reclaim this zone.

But the bearish force was clearly stronger. Even though several experts were bullish about the asset hitting a new high this month, a prominent analyst predicted a new timeline for this event.

Also Read: Brian Armstrong Shuts Down Coinbase (Paper Bitcoin) Rumors

Can Bitcoin Hit A New High in October?

According to a recent post, notable cryptocurrency trader Van De Poppe shed light on the upcoming price movements of the king coin. The analyst noted that BTC will surge and record a new high in the coming month.

However, before that, Bitcoin will encounter a slight hurdle. The asset will mainly see a setback to $57,000.

The analyst confirmed that Bitcoin will record an uptick following this. But he also pointed out that BTC needs to maintain its support in that area for the bullish rally to continue.

Impact Of The Upcoming FOMC Meeting

In addition, the upcoming FOMC meeting is expected to impact the king coin. The US Federal Reserve will pursue monetary easing through interest rate reductions, a significant shift in its monetary policy. Furthermore, the Fed rate drop will bring in more liquidity and boost the price of BTC.

Also Read: BRICS Surpasses G7 in Key Economic Areas: IMF Report