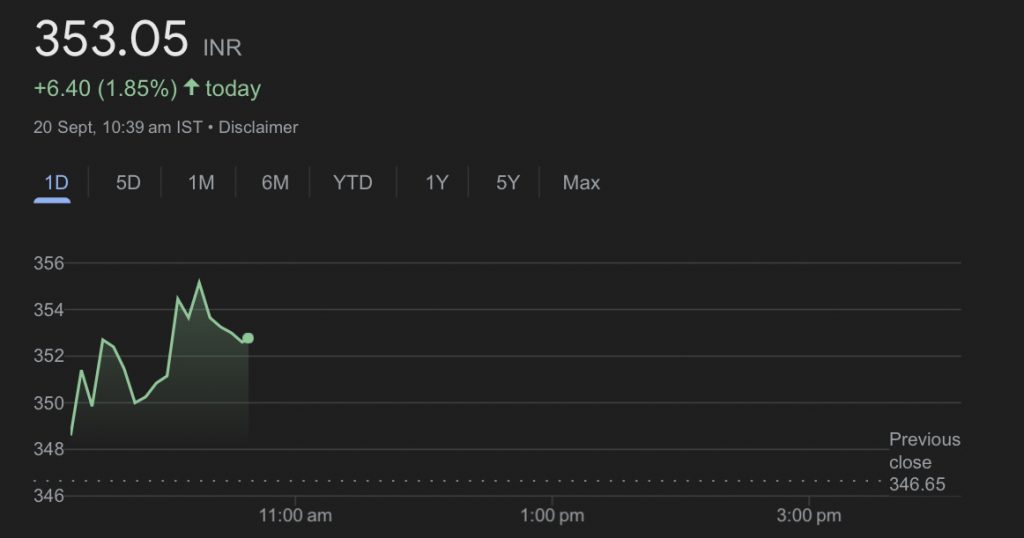

Jio Financial Services’ stock has recently been declining. During Thursday’s intraday session, the share price fell by 1.34%. According to BSE statistics, Jio Financial Services has a market capitalization of Rs 2.24 lakh crore. The stock has moved up to Rs 394.70 at its peak and down to Rs 204.25 throughout the last 52 weeks. Over the 24 hours, things took a turn for Jio Financial Services. The stock was trading at around Rs 352.80 following a 1.79% rise.

Also Read: Dogecoin: How To Become A Millionaire When DOGE Hits $1.2

Investors have managed to garner returns of 46% on their Jio Financial Services shares so far in 2024. According to BSE statistics, the stocks had a 47.12% one-year return. The company has a high price-to-earnings ratio and strong earnings potential. But it should be noted that these measures also signal that investors may be pricing in future growth.

Also Read: Buy Gold: Target Price $3,000, Says Analyst

Is Jio Financial Services A Good Bet?

The Jio stock has witnessed a major decline over the past four months. This has instilled doubt among its investors. But the real question is if holders should buy more, sell or continue holding the stock. Speaking about the same, Shiju Koothupalakkal, Technical Research Analyst told mint,

“With the RSI on the rise, we anticipate further rise, with immense upside potential visible from the current rate. With the chart technically well placed, we suggest buying the stock for an upside target of Rs 407, keeping the stop loss of Rs 333 level.”

In addition, a joint venture firm called “Jio BlackRock Investment Advisers Private Limited” was established on September 06, 2024 by Jio Financial Services and BlackRock Advisors Singapore Pte. Ltd. This was to conduct their principal business of providing investment advisory services.

Also Read: Confidence In Chinese Yuan Grows, US Dollar Declines