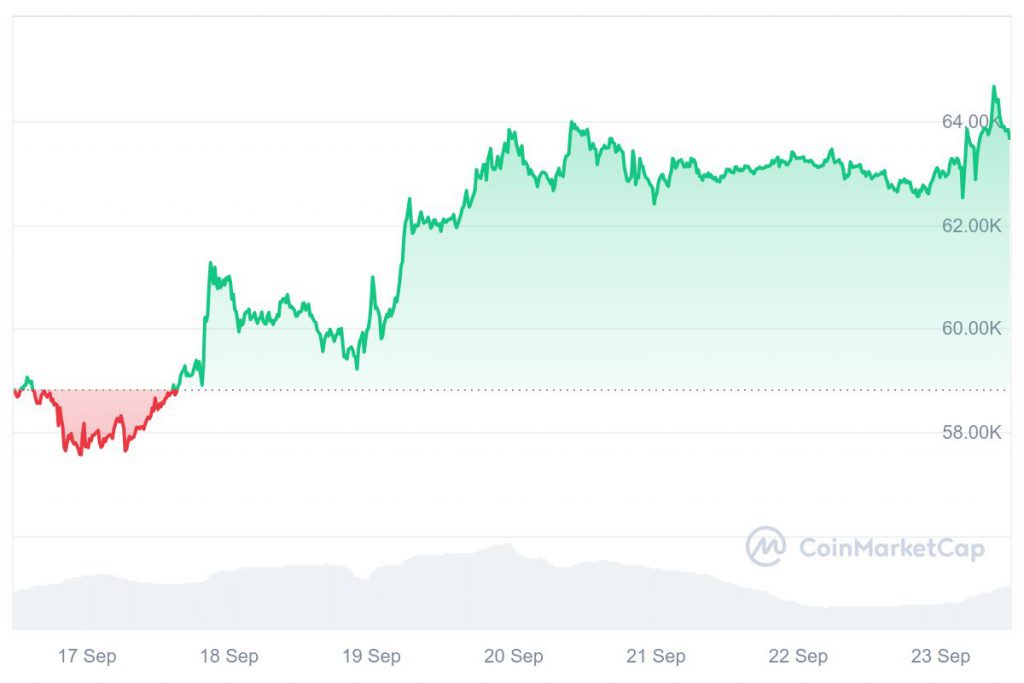

The year after the Bitcoin (BTC) halving is considered prominent for the king coin. Six months ago, BTC hit an all-time high of $73,750.07, even before the halving. The asset is trading 13% below this high at $63,676.27. Despite being in a rut, Bitcoin witnessed recovery as the asset rose by nearly 9% over the past week.

However, Bitcoin is expected to rise drastically in the coming months. Several institutions have predicted that BTC could surge to a high of $100K before 2025. The real question is how the asset could soar 58% as we inch closer to the end of the year.

Also Read: US Stock: Trending Share To Buy In September Per Market Experts

Here’s Why Bitcoin Could Rise To $100K

Historic Performance

Looking back at Bitcoin’s historic performance, the asset is expected to enjoy a great last quarter. Data reveals that BTC has ended seven out of eleven quarters well. Last year, the king coin surged by over 56% in the previous quarter. In addition, Q4 is considered the most bullish of the lot. The average quarterly returns stand at 88% for Bitcoin.

Also Read: When Will Nvidia Shares Reach New All-Time High? Analyst Explains

Impact Of US Elections

But that’s not all. The cryptocurrency industry may see a radical shift after the next US elections. In a recent interview with Bloomberg, SkyBridge Capital’s Anthony Scaramucci identified two key factors that would contribute to Bitcoin’s ascent to $100K. This includes lower interest rates and more specific industry regulations following the November US election. He added:

“We are going to get pro-cryptocurrency, Bitcoin, and stablecoin legislation in the first part of the next congressional term in the US. At the same time, you’re intersecting with rate cuts from the Federal Reserve.”

Bitcoin Cycle

Furthermore, the typical Bitcoin cycle begins around 170 days following the halving. With over 155 days since the April 19, 2024 halving, it appears that there are just two weeks left before the bull cycle resumes. According to the same data point, if this rally starts in the next two weeks, it would peak about 480 days after the halving, meaning that August 12, 2025, is when Bitcoin might reach its maximum.

Also Read: Shiba Inu: Projected Timeline For SHIB To Reach $0.002