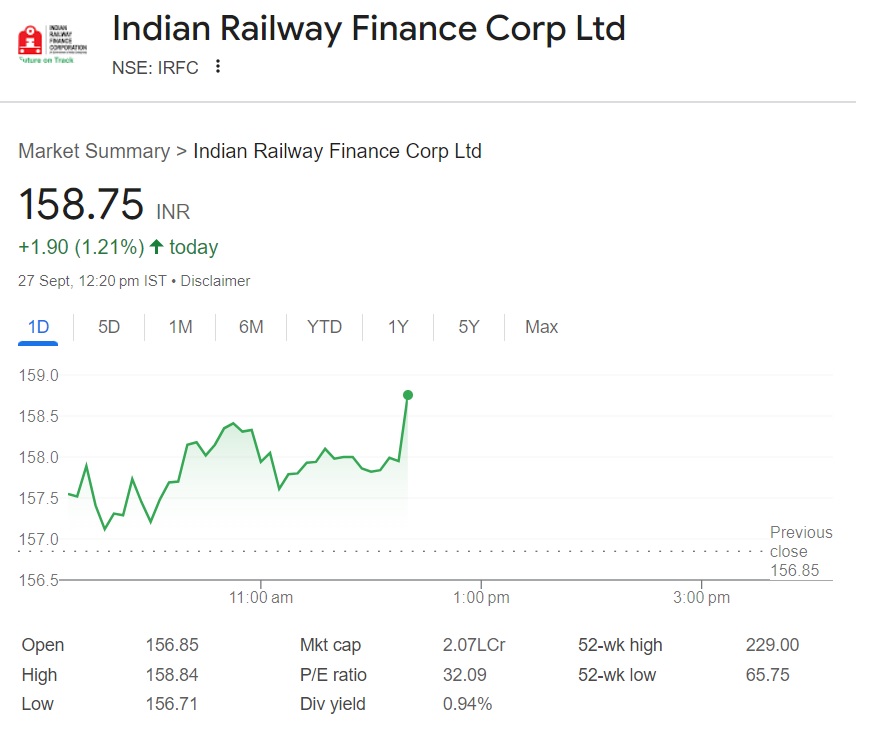

IRFC shares finally snapped its five-day losing streak on Friday as it surged close to 1.3% in the day’s trade. Despite today’s rise, the stock remains in the bearish territory as the risk of another dip looms. This puts the stock under pressure as investors are waiting to cash in only on the dips. The aggressive buying pressure has cooled down after it hit an all-time high of Rs 229 in July this year.

Also Read: Jio Financial Shares Eyes Target of 400: Rises Nearly 4% Today

Investors indulged in sell-offs and initiated profit bookings after it crossed above the 200 price level in Q3 of 2024. Since July onwards, IRFC shares have only been on the decline and plummeted close to 13% in the last 30 trading days. The buying pressure has dried up and investors are now waiting for it to bottom out in the charts to take an entry position.

In this article, we will explain how low IRFC shares could dip before investors can take an entry position again. The move could help traders to buy at the lowest point and hold on for the long term to gain maximum profits.

Also Read: 2 Nasdaq Stocks to Buy Before They Surge 50% and More

IRFC Shares: A Fall To 115-125 Price Level on the Cards

Source – CNBC

Anshul Jain, the Head of Research at Lakshmishree predicted that IRFC shares could experience further downturn in Q4. The stock is still overvalued at the 158-160 range and a potential dip is on the cards. Jain predicted that IRFC shares could fall to the Rs 115 to 125 price range and taking an entry position at this level is beneficial.

Also Read: US Stock: Apple Price Prediction For 2025

The analyst explained that IRFC shares remain solid for the long term and buying at the lowest price could reap maximum profits. “IRFC, which surged following the budget, is now facing a significant correction. Analysts predict a sharp pullback of nearly 50% from its recent highs, with the price likely to drop to the ₹115-₹125 range. Such corrections are common after strong rallies, and this may be an opportune time for short-term investors to consider exiting the stock,” he said.

“While long-term prospects remain solid, the short-term outlook has shifted. Investors could find better re-entry points once the stock stabilizes at lower levels. To protect recent gains, it’s advisable to step back now and wait for a more favorable buying opportunity in the future.” Jain added.